Many in the Prepper Community expect someday to experience an apocalyptic economic collapse. In preparation for this eventuality they may be stocking up on gold, bullets, or even cigarettes to use as currency once money has no value. If that is what you are hoping for, this article is not for you. Since no one can predict if or when an apocalyptic economic collapse will occur it may be wise to have a financial action plan that will help you prosper no matter what the economy is doing. My feeling is that potential job loss or a medical emergency are far more likely than an economic collapse and they can wreak just as much havoc on a household as an economic collapse can have on society. Simply playing the odds, it makes more sense to have a solid financial plan that does not hinge on the demise of currency and society.

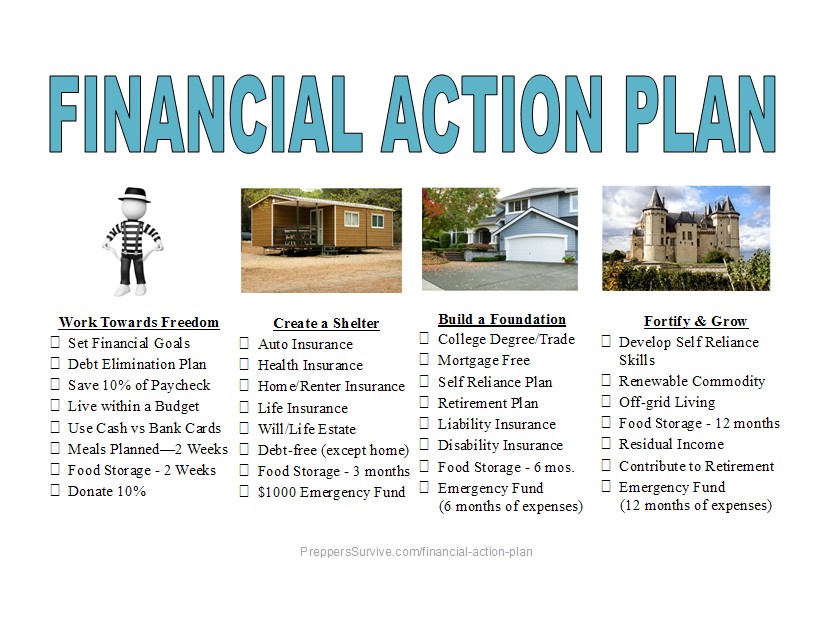

Below is a Four Tier Financial Action Plan Checklist that can help you work toward financial freedom. There is also a free printable Financial Action Plan Checklist at the bottom of this page.

Four Tier Financial Action Plan Checklist

Tier One – Work Towards Freedom

Much of Tier One is mental (an important element when preparing for just about anything). It is about making decisions and putting a plan in place. If you are serious about your finances most people can check off almost every item in Tier 1 within a few days. It feels good to know you have a plan in place and to feel like you are succeeding as you check items off the firs tier. It will not happen on accident so make a decision and take care of Tier One this week!

__ Set financial goals (This PDF is a great resource)

__ Use a Debt Elimination Plan

__ Save at least 10% of your paycheck

__ Live within a budget

__ Use cash instead of debit/credit cards

__ Create a two week plan for home cooked meals

__ Work towards having a two week supply of food storage

__ Donate 10% of your earnings to a charitable organization

Tier Two – Create A Shelter

Tier Two may offer a lot of quick wins but depending on your current financial situation it may take years to eliminate all of your debt. That is okay, you have a plan in place and consistent effort over time makes a huge difference. There is nothing sexy about paying an extra $50 on your auto loan, this is one of those private victories that result in a public success years down the road. Delaying gratification can be tough but pause and think for a moment about what you could do if the only debt in your budget were your home. You will have a flexibility in your budget that many people may never experience.

__ $1000 emergency fund in your saving account

__ Pay off all credit card debt, auto loans, and lines of credit

__ Work towards having a three month supply of food storage

__ Auto Insurance

__ Health Insurance

__ Home/Renter Insurance

__ Life Insurance

__ Will/Life Estate

Tier Three – Build a Foundation

Here we go, now we are getting to a place financially where you are starting to taste true freedom. Risk is substantially minimized, you are now in a position where you can really start to build wealth.

__ College Degree, Professional License, and/or Trade

__ Own Your Home (Mortgage-free)

__ Self Reliance Plan (Plant a garden and/or raise chickens)

__ Retirement Plan

__ Liability Insurance

__ Disability Insurance

__ Food Storage – 6 Months

__ Emergency Fund – 6 Months Worth of Expenses

Tier Four – Plan for Growth & Economic Changes

You built it, it is yours. Feel free to stock up on gold, ammunition, and whatever else helps you feel diversified because you can afford to be eccentric now. Congratulations, it was a journey that probably took years of consistent hard work and effort. Those who know this level of freedom stand by the decisions that they made early on in order to achieve the freedom that they now enjoy. Those that achieve this level say that it was worth the sacrifice. It will be for you too!

__ Develop self reliance skills to barter

__ Work towards living off-the-grid

__ Food Storage – 12 Months

__ Obtain a renewable commodity to barter (energy source such as solar panels, recharging items for others)

__ Residual Income (business owner, write a book, invent, invest, blog, rental property)

__ Contribute to Retirement

__ Emergency Fund – 12 Months Worth of Expenses

Printable Financial Action Plan Checklist PDF

Thanks for visiting Preppers Survive. Before you leave subscribe to our newsletter. If you enjoyed this article, please share it on your favorite social media.

Why cash as opposed to credit cards?

Great question!

To limit your reliance on financial institutions and start relying more on yourself. Changing how you spend money can change financial behaviors. It can also help keep to a budget.